AI & Technology: Reshaping Investment Intelligence

Discover how Artificial Intelligence, data analytics, and advanced automation are revolutionizing investment strategies, enhancing decision-making, and unlocking unprecedented competitive advantages in today's dynamic global markets.

Stay Ahead with AI-Powered Insights

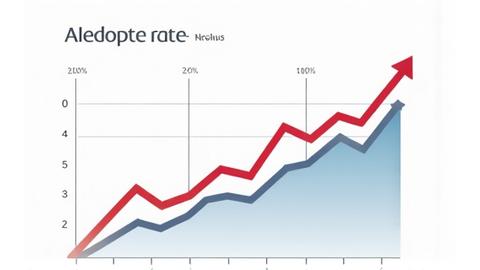

AI in Investment Management Overview

Track the accelerating adoption of AI across asset management firms globally. Our analysis provides insights into who's leading, where the growth lies, and the impact on market efficiency.

Explore how machine learning algorithms are enhancing portfolio optimization, risk management, and asset allocation, moving beyond traditional statistical models to uncover hidden patterns.

- Predictive Modeling

- Risk Factor Identification

- Adaptive Rebalancing

Understand the power of Natural Language Processing (NLP) for market sentiment analysis and the evolution of robo-advisory platforms, offering personalized and automated investment services.

Algorithmic Trading & Execution Technology

The pace of financial markets demands exceptional speed and precision. Our coverage delves into the intricacies of algorithmic trading systems, from high-frequency trading (HFT) to smart order routing, revealing how technology minimizes latency and maximizes execution efficiency.

- High-frequency trading dynamics and market impact

- Smart order routing for optimal execution

- Alternative data integration in trading algorithms

- Real-time risk management automation

Advanced Data Analytics & Alternative Data

Unlocking superior insights requires moving beyond traditional data sources. We track the innovative application of advanced data analytics and alternative data, providing a holistic view of market drivers and emerging opportunities.

Geospatial & Satellite Imagery

Analyze global economic activity through satellite imagery, tracking supply chain movements, retail foot traffic, and industrial output with unparalleled precision.

Social Media & News Sentiment

Leverage natural language processing to gauge public sentiment from social media and news feeds, providing early indicators of market shifts and brand perception changes.

Predictive Credit Risk & ESG Data

From real-time economic indicators to comprehensive ESG data, we cover how advanced analytics enhances credit risk modeling and incorporates sustainability metrics into investment decisions.

Machine Learning in Portfolio Management

Machine learning is not just for tech companies; it's a critical tool for sophisticated portfolio managers. We dissect practical applications that deliver tangible benefits.

Predictive Modeling for Asset Prices

Utilize ML to forecast asset movements with greater accuracy, identifying potential opportunities or risks before traditional models.

Pattern Recognition in Markets

Uncover subtle, complex patterns in market behavior, allowing for more nuanced strategic responses.

Automated Risk & Compliance

Implement automated stress testing, risk factor modeling, and anomaly detection for enhanced compliance and security.

Portfolio Optimization

Apply advanced ML techniques for truly dynamic and optimized portfolio construction, tailored to evolving market conditions.

Investment Technology Innovation

The innovation landscape is constantly shifting. Our tracker provides a clear view of emerging technologies and their potential to disrupt and enhance the investment ecosystem.

Blockchain & Digital Assets

From trade settlement efficiency to new digital asset classes, understand blockchain's transformative potential in finance.

Quantum Computing's Future

Explore the nascent yet profound implications of quantum computing for complex optimization problems in large-scale portfolios.

Cloud Infrastructure & Cybersecurity

Analyze the critical role of robust cloud solutions and advanced cybersecurity measures for secure, scalable financial operations.

Technology Implementation & ROI Analysis

Integrating new technology can be complex. We provide practical guidance on best practices for implementation, change management, and measuring tangible return on investment.

Strategic Implementation Frameworks

Access proven methodologies and frameworks for seamless technology adoption, minimizing disruption and maximizing benefits.

- Phased rollout strategies

- Cross-functional team integration

ROI Calculation & Vendor Due Diligence

Tools and insights to accurately calculate ROI for your tech investments and comprehensive guides for vendor selection and due diligence.

- Cost-benefit analysis templates

- Key performance indicator (KPI) tracking

- Vendor assessment checklists

Gain Your Competitive Edge with AI & Tech Insights

Don't let the rapid evolution of financial technology leave you behind. Subscribe to FinanceIntelPro for unparalleled access to the latest research, analysis, and strategic advisories on AI, automation, and data analytics in investment management.

Subscribe Now